What Are the Legal Protections for High-Asset Divorces in Texas?

In Texas, the law provides several protections for divorcing spouses in high-asset marriages. These protections are designed to ensure a fair and equitable distribution of assets and to safeguard the financial future of both parties.

One of the key legal protections is the concept of community property. In Texas, a community property state, any assets and debts accumulated during the marriage are regarded as jointly owned by both partners.

This includes everything from real estate and business interests to retirement accounts and personal property.

However, community property does not necessarily mean a 50/50 split. The court will consider a variety of factors, such as each spouse’s earning potential, the length of the marriage, and the needs of any minor children, to determine a fair division of assets.

What Happens to Separate Property in a High-Asset Divorce?

In a high-asset divorce, identifying and valuing separate property can be a complex process. This is where an experienced attorney can be invaluable. They can help you gather the necessary documentation, hire appraisers or other experts if needed, and advocate for your interests in court.

How Can a Prenuptial or Postnuptial Agreement Protect My Assets?

Prenuptial and postnuptial agreements are another important legal protection in high-asset divorces. In Texas, prenuptial and postnuptial agreements are generally enforceable as long as they are in writing and were voluntarily signed by both parties. However, the court can set aside an agreement if it finds that it was unconscionable when it was signed, or if one spouse did not fully disclose their assets and debts.

What Role Does Alimony Play in a High-Asset Divorce?

Alimony, also known as spousal support or maintenance, is another key consideration in high-asset divorces. In Texas, the court may order one spouse to pay alimony to the other for a period of time after the divorce. In high-asset divorces, alimony can be a significant financial obligation, so it’s crucial to have an experienced attorney on your side.

What Are the Tax Implications in a High-Asset Divorce?

In a high-asset divorce, tax implications can be significant and complex. Assets such as real estate, stocks, retirement accounts, and businesses all have potential tax consequences when they are divided or sold. For instance, selling a marital home may result in capital gains tax, while dividing a retirement account might trigger early withdrawal penalties.

Moreover, alimony payments also have tax implications. Prior to the Tax Cuts and Jobs Act of 2017, alimony payments were tax-deductible for the payer and taxable income for the recipient.

However, for divorces finalized after December 31, 2018, alimony payments are no longer tax-deductible for the payer, nor are they considered taxable income for the recipient.

How Is Business Ownership Handled in a High-Asset Divorce?

If one or both spouses own a business, this can add another layer of complexity to a high-asset divorce. The business may be considered either community or separate property, depending on when it was established and how it was funded.

If the business is deemed community property, it will need to be valued and divided equitably. This might involve one spouse buying out the other’s interest, selling the business and splitting the proceeds, or continuing to co-own the business after the divorce.

Determining the value of a business can be a complex process, requiring the expertise of business appraisers or financial analysts.

What Happens to Retirement Accounts in a High-Asset Divorce?

Retirement accounts, such as 401(k)s, IRAs, and pensions, are often one of the largest assets in a high-asset divorce. These accounts are typically considered community property and must be divided equitably.

However, dividing retirement accounts can be complex and may require a Qualified Domestic Relations Order (QDRO). A QDRO is a legal document that instructs the administrator of a retirement plan on how to divide the account between the divorcing spouses.

Without a QDRO, an early withdrawal from a retirement account can result in significant tax penalties. An experienced attorney can help ensure that your retirement accounts are divided correctly and that you avoid unnecessary tax liabilities.

How Are High-Value Personal Property and Collectibles Divided in a High-Asset Divorce?

High-value personal property and collectibles, such as artwork, jewelry, antiques, and luxury vehicles, can also be a point of contention in a high-asset divorce. These items may have both financial and sentimental value, making them difficult to divide.

In Texas, these items are typically considered community property and must be divided equitably. However, determining the value of unique items can be challenging and may require professional appraisals.

How Are Trusts and Inheritances Handled in a High-Asset Divorce?

Trusts and inheritances can add another layer of complexity to a high-asset divorce. In Texas, property acquired through inheritance is typically considered separate property and is not subject to division in a divorce. However, the situation can become complicated if the inherited property has been commingled with community property.

Trusts, on the other hand, can be particularly complex. The way a trust is treated in a divorce depends on various factors, including the type of trust, who the beneficiaries are, and when it was established.

How Can I Protect My Business Interests in a High-Asset Divorce?

If you own a business, protecting your business interests should be a top priority in a high-asset divorce. There are several strategies you can use to protect your business, including:

– Creating a prenuptial or postnuptial agreement that specifies how the business will be treated in a divorce.

– Keeping your business and personal finances separate to avoid commingling.

– Paying yourself a competitive salary to reduce the likelihood of your spouse claiming they are entitled to a share of the business because they were deprived of marital income.

– Establishing a buy-sell agreement that limits your spouse’s ability to acquire ownership interest in the business.

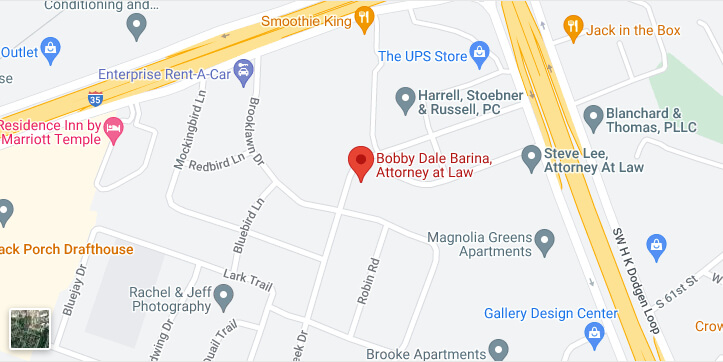

If you are facing a high-asset divorce, call Barina Law Group, PLLC today at 254-274-2227 for a confidential consultation.

CALL US NOW

CALL US NOW